SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

Menu

From Ledgers to Lending Bots: Your Future in Digital Financial Management

Introduction

The world of finance is undergoing a monumental shift. Forget the stereotypical image of a bespectacled accountant hunched over endless paper ledgers. The future is digital, data-driven, and incredibly dynamic. For students pursuing a BBA in Financial Management, this evolution isn't a threat; it's a golden opportunity. Your degree is the key that unlocks a new world of possibilities, but to thrive, you must understand the landscape you're entering.

The traditional pillars of finance are being reshaped by technology. Concepts like blockchain, artificial intelligence (AI), and machine learning are no longer just buzzwords. They are the new tools of the trade, automating tasks, predicting market trends, and personalizing financial services. This transformation is creating a demand for a new kind of professional – one who is not only fluent in financial principles but also digitally savvy.

Why Your BBA in Financial Management Matters?

A strong foundation is non-negotiable. Your BBA in Financial Management provides you with the core competencies that technology cannot replicate. You're learning the "why" behind the "what." Understanding financial statements, mastering valuation techniques, and comprehending risk management principles are the bedrock of your career. These are the skills that allow you to interpret data, not just collect it.

Consider the role of Accounting for Business. While software can now automate much of the bookkeeping process, the need for a professional to interpret financial reports and make strategic business decisions remains paramount. A software program can't advise a CEO on a major acquisition; that requires human judgment, honed through your university studies. According to a report by McKinsey & Company, while up to 50% of current work activities could be automated by adapting existing technology, the demand for skills like creativity, critical thinking, and social and emotional intelligence will actually rise. This is where your BBA in Financial Management gives you a significant edge. The fundamental principles you learn in your BBA in Financial Management program are timeless, regardless of the tools you use.

New Roles in Finance

The Future of Finance Careers is not about replacing humans with machines; it's about augmenting human capabilities. AI-powered algorithms can analyze massive datasets in seconds, identifying patterns that would take a human months to uncover. This frees up financial professionals to focus on higher-level, more strategic tasks.

For a student of BBA, your learnings could evolve from a data entry to a data strategy. You'll be using tools to visualize complex data, create sophisticated financial models, and communicate your findings to stakeholders. A lending bot can process a loan application in minutes, but it's a financial analyst who designs the underlying risk model and evaluates the bot's performance. The emergence of Fintech, or financial technology, is a testament to this shift. Companies like Stripe, Square, and PayPal have revolutionized how we transact. Your BBA in Financial Management will equip you to understand the business models behind these innovations, whether you choose to work for a traditional bank or a cutting-edge startup.

Making Decisions with Data

The most valuable asset in the modern economy is data. Data-Driven Finance is not just a concept; it's the new reality. Financial decisions, from investment strategies to credit approvals, are increasingly based on predictive analytics and machine learning models.

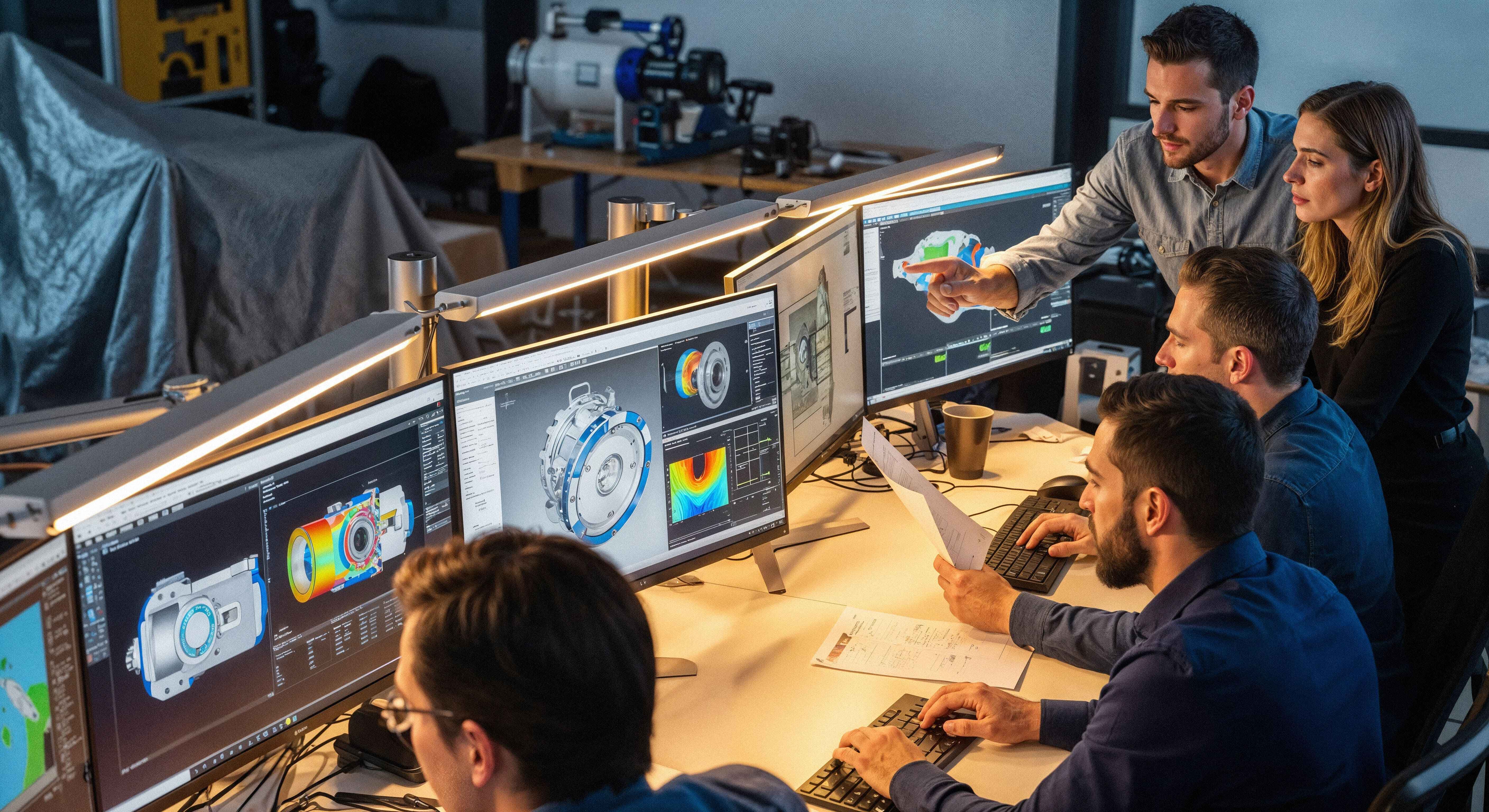

For students of a BBA in Financial Management, this means that alongside learning financial theory, you must also embrace data literacy. This doesn't mean you need to become a full-fledged data scientist. It means you should be comfortable with data analytics tools, understand the basics of statistical analysis, and be able to tell a compelling story using data. This skillset will make you an indispensable asset in any organization. Imagine working in wealth management. Instead of manually reviewing a client's portfolio, you could use an AI tool to instantly analyze market trends and recommend personalized investment strategies. Your BBA in Financial Management provides you with the knowledge to evaluate the effectiveness of these recommendations and communicate them clearly to your client.

A recent survey by Deloitte shows that over 80% of finance leaders believe that advanced analytics and AI will significantly impact their organizations within the next five years. This highlights the importance of integrating these skills with the core knowledge you gain from your BBA in Financial Management.

Your Next Steps

So, what does this all mean for you, a student of BBA Financial Management? It means your education is more relevant than ever, but you must be proactive in shaping your career. Here are some actionable steps:

- Embrace Technology: Seek out courses or certifications in data analytics, Python for finance, or business intelligence tools.

- Stay Curious: Read industry reports, follow Fintech news, and understand the technological trends shaping the sector.

- Develop Soft Skills: Communication, teamwork, and critical thinking will differentiate you from a machine. Your BBA in Financial Management program likely emphasizes these skills, so take full advantage.

- Internships: An internship in a Fintech company or a financial institution using advanced technology will give you invaluable hands-on experience.

Conclusion

The journey from ledgers to lending bots is well underway. Your BBA in Financial Management is not just a degree; it's a launchpad.

It provides the essential knowledge to understand the financial world, while the digital revolution offers you the opportunity to innovate within it.

The future isn't just about managing money; it's about leveraging technology to create new value. Are you ready to lead the way? The world of finance awaits. Learn and grow your career with SIMT Programs. Admissions are open, enroll today.