SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

SIMT

SITASRM INSTITUTE OF MANAGEMENT & TECHNOLOGY

Menu

The Middle East Conflict Impact on India's Global Trade Routes

Introduction to Middle East Conflict Impact On India

The Middle East is, once again, a focal point of global tension. Recent escalations between Israel and Iran have sent ripples of concern through international markets. For students specializing in International Business, understanding these dynamics isn't just about geopolitics; it's about recognizing critical vulnerabilities in global supply chains. The Middle East conflict impact on India is a primary concern, directly translating into tangible economic consequences across various sectors.

The Latest Escalation: A Brief Overview

As of June 2025, the region has witnessed a significant spike in hostilities. Israel launched air offensives against Iranian military and nuclear facilities. Iran retaliated with missile and drone barrages against Israel. The conflict escalated further with US military airstrikes on key Iranian nuclear sites (Fordo, Natanz, Isfahan) on June 21, 2025. Tehran responded by targeting the US Al Udeid Air Base in Qatar with missiles. While a ceasefire was announced on June 23, 2025, reports from both Tehran and Jerusalem indicate continued missile fire and skepticism about the agreement's strength. This volatile situation underscores the fragility of stability in a region vital to global commerce, and its direct Middle East conflict impact on India.

Why the Strait of Hormuz is a Critical Chokepoint

Imagine a narrow bottleneck through which flows a significant portion of the world's lifeblood – energy and goods. That's the Strait of Hormuz. This vital maritime chokepoint connects the Persian Gulf to the Gulf of Oman and the Arabian Sea. It's only 33 kilometers (21 miles) wide at its narrowest point, with shipping lanes just 3 kilometers wide in each direction.

Through this narrow passage, roughly 20% of the world's daily oil supply – around 20 million barrels – passes. Major oil exporters like Saudi Arabia, the UAE, Iraq, Iran, Kuwait, and Bahrain depend on it. Crucially, about 84% of this oil, along with significant volumes of liquefied natural gas (LNG) from Qatar, is bound for Asia. Any impediment here affects global energy markets immediately. The Strait of Hormuz disruption directly heightens the Middle East conflict impact on India. Nearly two-thirds of India's crude oil and half its liquefied natural gas (LNG) imports transit through this Strait.

Direct Impacts on India's International Business

The escalating Middle East tensions directly translate into severe challenges for international businesses, with a distinct Middle East conflict impacting India:

-

Soaring Shipping Costs:

Even verbal threats from Iran to close the Strait of Hormuz, as observed from their parliament's recommendation on Sunday, June 22, 2025, cause alarm. If such actions materialize, shipping costs will surge dramatically. Recent reports indicate freight costs for major trading destinations, including the Gulf, have jumped by 20-25%. For example, a 40-ft container shipment to Dubai's Jebel Ali port, previously $50, now costs $550. This immediate hike burdens importers and exporters globally, directly adding to the Middle East conflict that impacts India's trade balance. Sectors from textiles to electronics feel this pressure.

-

Skyrocketing Insurance Premiums:

Maritime security firms and insurers are on high alert. The region is already classified as a "High Risk Area" for marine insurance. Following recent escalations and US involvement, war risk premiums for vessels transiting the Persian Gulf have surged. Experts indicate a 60% jump, with premiums for Israeli port calls more than tripling. For a typical Very Large Crude Carrier (VLCC) from the Middle East to a major Asian port, insurance costs have reportedly risen from $0.25 to $0.7-0.8 per barrel overnight (Times of India, June 24, 2025). Some insurers are even rolling out "blocking and trapping" cover, a testament to the heightened risk of vessels being immobilized. This directly impacts the profitability of international trade and exemplifies the tangible Middle East conflict impact on India's import bill.

-

Supply Chain Vulnerabilities:

The Strait of Hormuz disruption creates immense supply chain vulnerabilities. Most volumes transiting Hormuz have no viable alternative. While some nations have pipelines that can bypass the Strait, their capacity is insufficient to replace the entire flow. This means that manufacturing output, heavily reliant on Persian Gulf energy, could face significant disruptions and potential shortages of gasoline, diesel, and jet fuel. International companies need to re-evaluate their entire global distribution strategies, looking for diversified energy sources and potentially regionalizing supply chains to reduce reliance on this single, volatile chokepoint. This amplifies the Middle East conflict's impact on India's industrial output and inflation.

-

Increased Market Volatility and Inflationary Pressures:

Global oil prices directly react to these tensions. On Monday, June 23, 2025, crude oil prices jumped to their highest since January, with Brent surging 2.44% to $78.89 a barrel. While many analysts believe a complete, sustained closure is unlikely, even the threat of disruption drives market volatility. This uncertainty makes forecasting, budgeting, and long-term planning extremely difficult for international businesses. A prolonged surge above $100 a barrel could significantly impact economic growth and fuel inflation in the country, a key aspect of the Middle East conflict impacting India. Crisil Ratings has cautioned that prolonged conflict could aggravate risks, raise inflation, and pressure margins in oil-dependent sectors.

-

Impact on Specific Sectors and Trade:

Beyond energy, sectors heavily reliant on Middle Eastern energy (refining, chemicals, fertilizers, transport) are directly hit. Trade flows, particularly for perishable commodities like basmati rice, bananas, and tea, often destined for the Middle East, are already facing disruptions and stranded consignments due to payment and shipping issues. Nearly one lakh tonnes of basmati rice shipments bound for Iran have been stranded at ports (Times of India, June 23, 2025). This highlights the broad ripple effect of the Middle East conflict over India's diverse export basket and key agricultural sectors. The apparel and textile sectors are also seeing rising polyester and viscose prices due to crude oil hikes.

The US Navy Presence and Russia's Position: Strategic Considerations

The continuous presence of the US Navy in the region serves as a deterrent against a full closure of the Strait of Hormuz. The US has historically shown a willingness to intervene to keep the strait open. However, this presence also makes US-affiliated vessels potential targets, raising the stakes and increasing the risk of direct confrontation. This adds another layer of complexity for international logistics and maritime security.

Meanwhile, Russia's continued diplomatic and strategic support for Iran, even amidst the recent escalation and US strikes, further complicates the geopolitical landscape. This tacit alliance influences the resolve of regional players and the broader international response, a crucial factor when assessing the overall Middle East conflict.

Your Future in International Business with SIMT

The Middle East conflict impact on India is profound. The Strait of Hormuz disruption from escalating Middle East tensions is a stark reminder for students of the critical interplay between geopolitics and international business. The days of stable, predictable global trade routes are increasingly challenged by regional conflicts, major power dynamics, and the weaponization of economic tools.

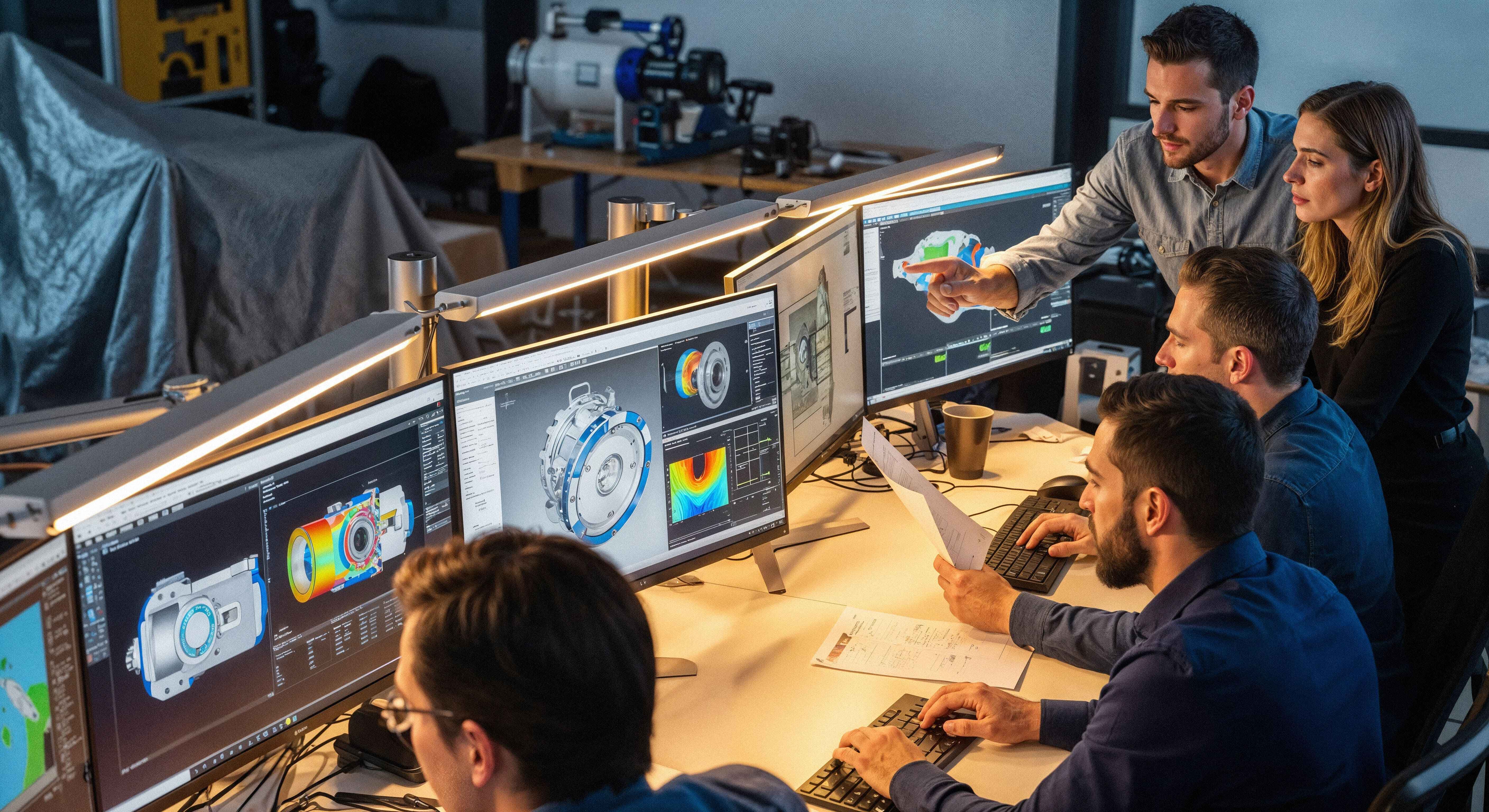

At SITASRM Institute of Management and Technology (SIMT), we understand that navigating such complex global landscapes requires specialized expertise. That's why we offer our students multiple MBA programs with dual specializations, allowing them to tailor their education to their career aspirations.

Our MBA in International Business (IB) provides a deep dive into global trade dynamics, geopolitical risk analysis, cross-cultural management, and international finance – all essential skills to comprehend and mitigate the Middle East conflict impact on India. Beyond IB, students can choose from a range of other specializations like HR, Marketing, Finance, Operations, Business Analytics, and IT.

These specializations enable students to gain versatile skills relevant to their interests. Explore our diverse MBA programs at simt.net.in and take your first step towards becoming a future-ready, globally aware business leader.

.jpg)